Thoughts Of A Designer #14: Designing Financial Freedom - Bitcoin, Inflation, and the Future of Money

- Gueston Smith

- Dec 15, 2024

- 7 min read

Updated: Feb 18

"The future of money lies in freedom, not control."

There comes a moment in every truth seeker's journey when the veil is lifted, and we see the world for what it truly is. For me, this moment came when I reevaluated everything I thought I knew about money—how it works, how it flows, and how it impacts our lives.

The Wake-Up Call: My Journey Toward Financial Freedom

I need to be vulnerable with you. Despite my passion for economics (I was even awarded "most outstanding student" in my high school economics class), I found myself accumulating $40,000 in consumer credit card debt. This wasn't the plan. But sometimes our greatest challenges become our greatest teachers. My focus has been on creating investment vehicles that will supercharge my future. I'm proud of what I've created so far but here’s what I learned: our current financial system is designed to trap us in cycles of debt while making it increasingly difficult to build real wealth. As a designer, I’ve trained myself to spot patterns and analyze systems. What I see in our financial system both concerns and motivates me. Money will become completely digital.

The Hidden Wealth Killer: Understanding Inflation

Let’s break this down simply:

The dollar is fiat money — backed by nothing but government promises. It used to be backed by Gold but that was ended in 1971 by president Nixon.

When governments print more money, your savings lose value.

Inflation isn’t just an inconvenience—it’s a silent wealth destroyer.

Think of inflation like a leak in your savings bucket. No matter how much you save in traditional accounts, you're losing purchasing power every year. Over time, what once felt secure begins to feel like sand slipping through your fingers.

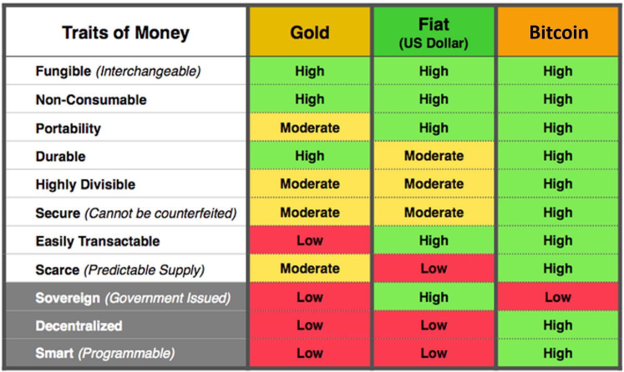

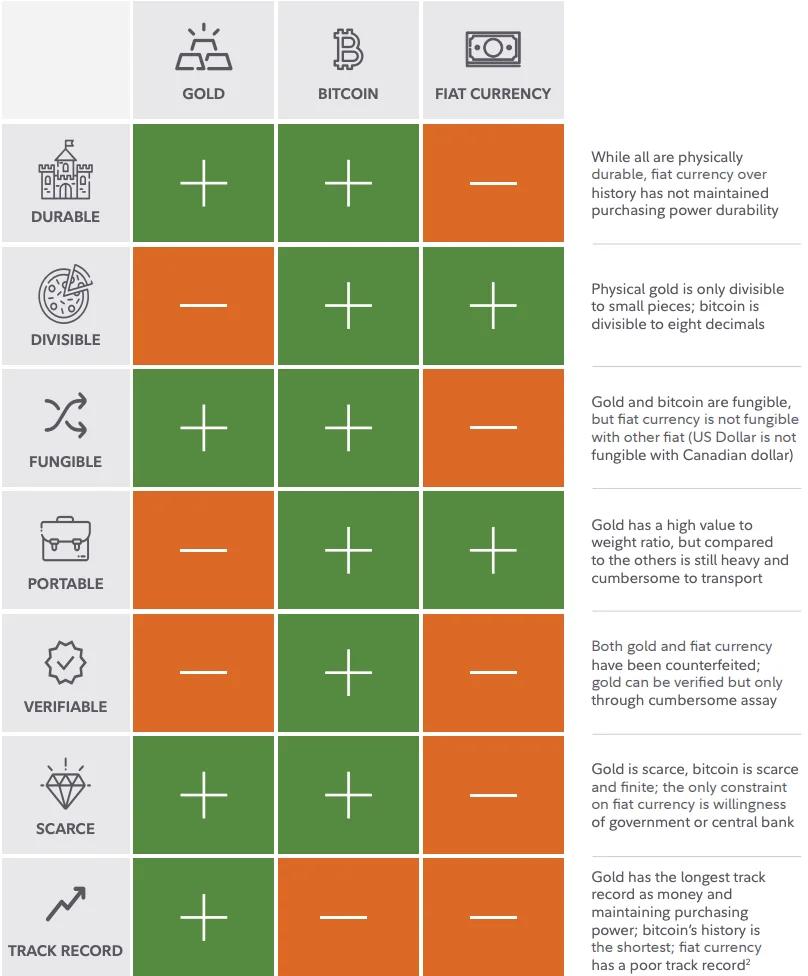

Characteristics of Money

For any form of money to be effective, it must possess key attributes that determine its usability and reliability. These characteristics define the strength and utility of a currency in facilitating trade, preserving value, and fostering financial stability.

Fungibility (Interchangeability)

Every unit of money should be identical in value and function. One dollar, one ounce of gold, or one Bitcoin should be interchangeable with itself. For example, One dollar is always equal to another dollar, that's why it is our money.

Durability (Longevity & Resistance to Wear)

Money should be able to withstand the test of time and maintain its functionality. It should not degrade or become unusable due to environmental factors or repeated use.

Portability (Ease of Transport & Transfer)

Money must be easy to carry and move across distances. The more efficiently it can be transferred—physically or digitally—the more practical it becomes for trade and commerce.

Divisibility (Breaking Down into Smaller Units)

Money should be divisible into smaller units to accommodate transactions of all sizes. This allows for precision in pricing and accessibility across various economic activities.

Scarcity (Limited Supply for Value Retention)

For money to hold value over time, its supply must be limited. If it can be endlessly created, its purchasing power diminishes, leading to inflation and loss of wealth. This is what we are seeing in our economy today. This is why everything is getting more expensive.

Security (Resistance to Counterfeiting & Fraud)

A sound form of money must be difficult or impossible to counterfeit. It should have inherent safeguards that maintain its authenticity and integrity.

Verifiability (Ease of Authenticity Checks)

People must be able to easily verify that the money they receive is legitimate without relying on central authorities or complicated procedures.

Established History (Proven Track Record of Reliability)

A currency's longevity contributes to its trustworthiness. The longer it has successfully functioned as money, the more confidence people have in its continued stability.

Censorship Resistance (Freedom from Control & Manipulation)

True money should not be subject to political interference, government freezes, or restrictions on how and when it can be used.

Open Programmability (Ability to Be Integrated & Automated)

In the digital era, money must be adaptable to technological advancements. It should be able to interact with smart contracts, automated systems, and new financial infrastructures.

Decentralization (Independence from Central Authorities)

For ultimate financial freedom, money should not be controlled by a single entity. Decentralization ensures resilience, trustlessness, and protection from systemic failures.

As you can see, when we consider the characteristics of money, some are more practical than others.

Bitcoin: The Digital Solution to Physical Problems

Understanding Bitcoin as a Protocol

Bitcoin isn’t just another technology; it’s a protocol—a foundational set of rules that governs how the system operates. Protocols like TCP/IP (Transmission Control Protocol/Internet Protocol), which power the internet, are rare because they form the enduring infrastructure for everything built on top of them. Similarly, Bitcoin’s protocol creates a decentralized monetary system that is mathematically engineered and has been objectively true for the past 16 years.

Here’s why this matters:

Protocols Are Resilient: Technologies often evolve and become obsolete, but protocols endure. TCP/IP, developed in the late 1960s, still underpins the internet today. Bitcoin, as a protocol, establishes the foundation for a global, decentralized financial system that operates beyond borders.

Mathematical Certainty: Bitcoin’s protocol ensures scarcity (only 21 million coins will ever exist), security through cryptographic proof, and decentralization via distributed nodes.

Bound by Energy: Bitcoin’s Proof of Work mechanism ties it to physical energy, ensuring fairness and grounding it in the real world.

When we participate in the Bitcoin network, you’re not just a user—you’re an enforcer of this honest protocol. Together, individuals globally uphold this system, making Bitcoin an asset based on collective effort rooted in transparency and trustless security.

Bitcoin: The Digital Solution to Physical Problems

Here’s why Bitcoin represents true freedom:

📈 Scarcity

Only 21 million Bitcoin will ever exist.

No government can print more.

Mathematically guaranteed scarcity makes Bitcoin the most deflationary asset ever created.

Supply & Demand. Limited Supply + High Demand = High Value

🔒 Security

Built on blockchain technology: transparent yet private.

Decentralized—no single entity can control it. You are sole custody of your money. That is freedom.

A system with no central point of failure.

Protected from Fraud, just don't lose your passcodes.

💡 Innovation

Digital native money for a digital age.

Programmable, adaptable, and constantly evolving.

A foundation for the future of finance.

Bitcoin isn’t just about money; it’s about trust. It’s a solution designed to address the systemic problems that fiat currency and traditional financial systems cannot fix.

Following the Smart Money: Institutional Adoption

The largest players in finance are already moving in. This isn’t speculation—it’s happening right now:

Major Bitcoin Holdings:

- U.S. Spot ETFs: 1,104,534 BTC

- Binance: 633,000 BTC

- MicroStrategy: 461,000 BTC

- U.S. Government: 198,109 BTCUnder the leadership of Michael Saylor, MicroStrategy has essentially become a Bitcoin Treasury. Their recent addition to the Nasdaq-100 signals mainstream acceptance of Bitcoin as a strategic asset.

If major institutions are allocating billions into Bitcoin, shouldn’t we take notice? This is about seeing the signs and positioning yourself for what’s coming.

Your Path to Financial Freedom

Here’s an actionable blueprint to start designing your financial sovereignty:

Educate Yourself

Study Bitcoin fundamentals & History.

Understand blockchain technology and why it matters.

Research starting with thought leaders like Michael Saylor, Jeff Booth and Chris Johnson.

Start Small

Don’t wait for the perfect moment—it doesn’t exist.

Dollar-cost average into Bitcoin consistently, no matter how small.

Think long-term, not quick profits. They say it's going to a million a coin.

Think of it as your savings account.

Buy on a trusted crypto exchange but don't keep it there. I use Crypto.com

SELF CUSTODY! Buy a Cold Wallet to send all of your crypto currency. Ledger or Trezor wallets are most common

Pay Down Debt

Tackle high-interest liabilities first.

Balance paying off debt with building assets.

Build Wealth Systematically

Accumulate Bitcoin regularly.

Focus on appreciating assets that provide equity and freedom.

A Designer's Perspective: Building Systems for Freedom

As an innovative designer, I see Bitcoin as more than money—it’s a perfectly designed solution to a deeply flawed financial system. It’s about:

Autonomy over authority - It's a Trustless System.

Mathematics over manipulation

Freedom over control

This is about empowering individuals. It’s about creating a system that allows everyday people to protect and grow their wealth without interference.

Moving Forward Together

Yes, I have credit card debt. Yes, I’m still learning and growing. But I’m also building assets ($140K and counting)(Index Funds, ETFs, Dividend Stocks, Tech / Ai Stocks, Bitcoin, Cryptocurrency) and looking toward the future with optimism. Because this journey isn’t just about money—it’s about freedom, independence, and taking control of our financial destinies. True freedom is waking up and having the ability to choose what you will be doing with your day. This is an opportunity to join a global free market with a secure, decentralized protocol bound by energy. We’re moving toward a digital future and expanded consciousness. The power needs to return to individuals, and Bitcoin is the technology making this possible. All prices (stocks, crypto, indexes, real estate) will fall to Bitcoin. Move your time to it.

Bitcoin will either go to zero or to a million. & Looking at institutional adoption and it's growth progress, I believe the direction is clear. It's up.

"Bitcoin is about freedom, not flashy shxt."* — Chris Johnson

I'm still learning but I want to share what I'm learning with you. Do some research.

Follow the Money. We are still very early. It is not too late. Go Learn about why the messaging around this is working to deter us from saving into freedom. Food for Thought.

Stay away from the majority of other Cryptos. It's gambling and the rug can be pulled from underneath you. Bitcoin isn't run by anyone.

My only other suggestion is to research XRP (lighting fast cross border money processor) & XLM. It's very interesting and has survived for many years.

With gratitude and optimism for our financial future,

Gueston Smith

📖 Essential Resources

Bitcoin 101 (3 Minute Animated Introduction)

Earn Your Leisure - Why Bitcoin is the Future with Chris Johnson

Disclaimer: This reflects my personal journey and research. Always do your own research and consult financial professionals for advice. This is not financial advise. It is information for you to consider when making an informed decision about what to do with your money.

Comentários